CrowdStrike Stock Gave Triangle Breakout: Will the Uptrend Continue?

- CrowdStrike Holdings Inc.’s actual earnings are more than the expected earnings.

- The CRWD stock price has given a return of more than 30% in a year.

- The technical analyst gives a strong buy recommendation for the CRWD stock.

CrowdStrike Holdings, Inc. delivers cybersecurity solutions designed to prevent security breaches. Their offerings encompass cloud-based protection for various aspects, including endpoints, cloud workloads, identity, and data security.

CrowdStrike Holdings, Inc.’s stock price is on an upward trajectory, marked by a series of higher highs.

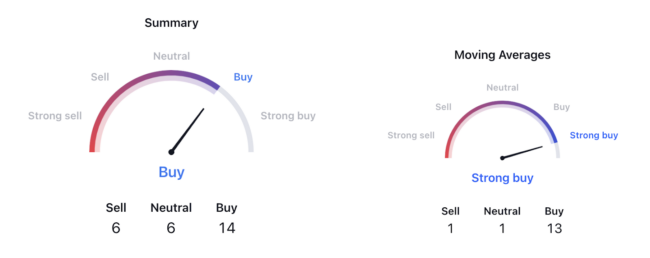

The technical analysis indicators favour a buy signal for the CRWD stock. Out of the 26 indicators, the majority suggest a buy position, with only a few showing negative signals. The moving averages summary also strongly advises buying the stock, indicating a clear uptrend.

Over the past year, CrowdStrike Holdings’ stock price has surged by 30%, demonstrating its strong performance. This notable increase may attract potential buyers to the stock.

The earnings of the company have increased along with the profit margin. It indicates the strong finances of the company. Also, the actual earnings of the firm have shown a 22% increase than the expected earnings.

According to analyst ratings on TradingView, the expected target price for CRWD in the coming months is $193.8. It reflects a 3% increase from its current value.

Following a peak at $298, the CRWD stock experienced a 69% decline. However, it found support at the $92 level, leading to a trend reversal. Currently, the stock price has broken out of an ascending triangle pattern, signalling the potential for further price increases.

The CRWD stock price is positioned favourably and exhibits a robust structure. It’s likely to see further gains in the near future, especially considering its 104% increase after finding solid support.

CrowdStrike Holdings, Inc. (CRWD) Stock Price Analysis

CRWD by writer50_tcr on TradingView.com

Technical Indicator:

Analyzing the CRWD stock’s indicators, both the MACD line and the signal line are positioned above the zero line. Moreover, there’s a green histogram indicating a strong uptrend.

The RSI line and the 14-day SMA line for the CRWD share are both situated around the 70 level, firmly within the positive territory. This suggests potential future price increases.

Conclusion

According to the assessment, the CRWD stock of CrowdStrike Holdings, Inc. is currently on an upward trajectory and is anticipated to continue rising in the future. With the price reaching new highs and positive signals from various indicators, it is likely that the stock’s price will experience further increases in the days ahead.

Technical Levels

- Support Level– $92.

- Resistance Level– $200.

Disclaimer

The views and opinions of the author, or anyone named in this article, are for informational purposes only. They do not offer financial, investment, or other advice. Investing or trading crypto assets involves the risk of financial loss.